Little Known Questions About Hard Money Atlanta.

Wiki Article

A Biased View of Hard Money Atlanta

Table of ContentsThe Ultimate Guide To Hard Money AtlantaThe Greatest Guide To Hard Money AtlantaThe 9-Second Trick For Hard Money AtlantaFacts About Hard Money Atlanta UncoveredRumored Buzz on Hard Money Atlanta

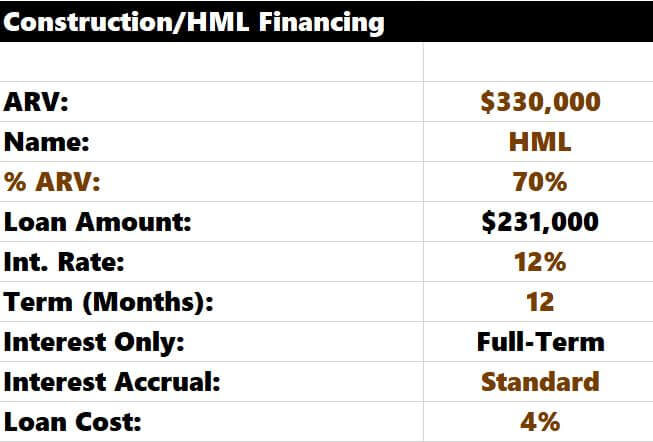

In the majority of locations, rate of interest on hard money finances range from 10% to 15%. Furthermore, a borrower may require to pay 3 to 5 factors, based upon the overall loan quantity, plus any type of appropriate evaluation, evaluation, as well as management fees. Many tough cash lending institutions call for interest-only repayments throughout the brief duration of the funding. hard money atlanta.Difficult money lenders make their cash from the passion, factors, as well as charges credited the borrower. These lending institutions aim to make a fast turn-around on their investment, thus the greater rate of interest and much shorter regards to difficult money loans. A tough cash funding is a great concept if a borrower needs cash rapidly to purchase a home that can be rehabbed as well as flipped, or rehabbed, rented out and also re-financed in a relatively brief time period.

The Best Guide To Hard Money Atlanta

For personal capitalists, the very best part of getting a difficult cash financing is that it is simpler than getting a traditional home mortgage from a financial institution. The authorization procedure is generally much less intense. Banks can ask for an almost limitless collection of documents and take several weeks to months to get a funding authorized.The main purpose is to make sure the borrower has a departure technique and isn't in financial ruin. Many tough cash lenders will certainly work with individuals that don't have fantastic credit rating, as this isn't their largest worry. The most vital thing difficult money lending institutions will consider is the financial investment home itself.

What Does Hard Money Atlanta Mean?

Yet there is one more advantage developed into this process: You get a 2nd set of eyes on your deal and one that is materially purchased the task's outcome at that! If a bargain misbehaves, you can be relatively certain that a difficult money lending institution won't touch it. You need to never use that as an excuse to forgo your very own due diligence.The most effective location to look for hard cash loan providers is in the Larger, Pockets Tough Cash Loan Provider Directory Site or your local Property Investors Association. Remember, if they've done right by one more financier, they are most likely to do right by you.

Check out on as we discuss tough money lendings and why they are such an appealing choice for fix-and-flip real estate investors. One significant advantage of tough money for a fix-and-flip capitalist is leveraging a trusted lender's reliable funding and speed.

Some Known Incorrect Statements About Hard Money Atlanta

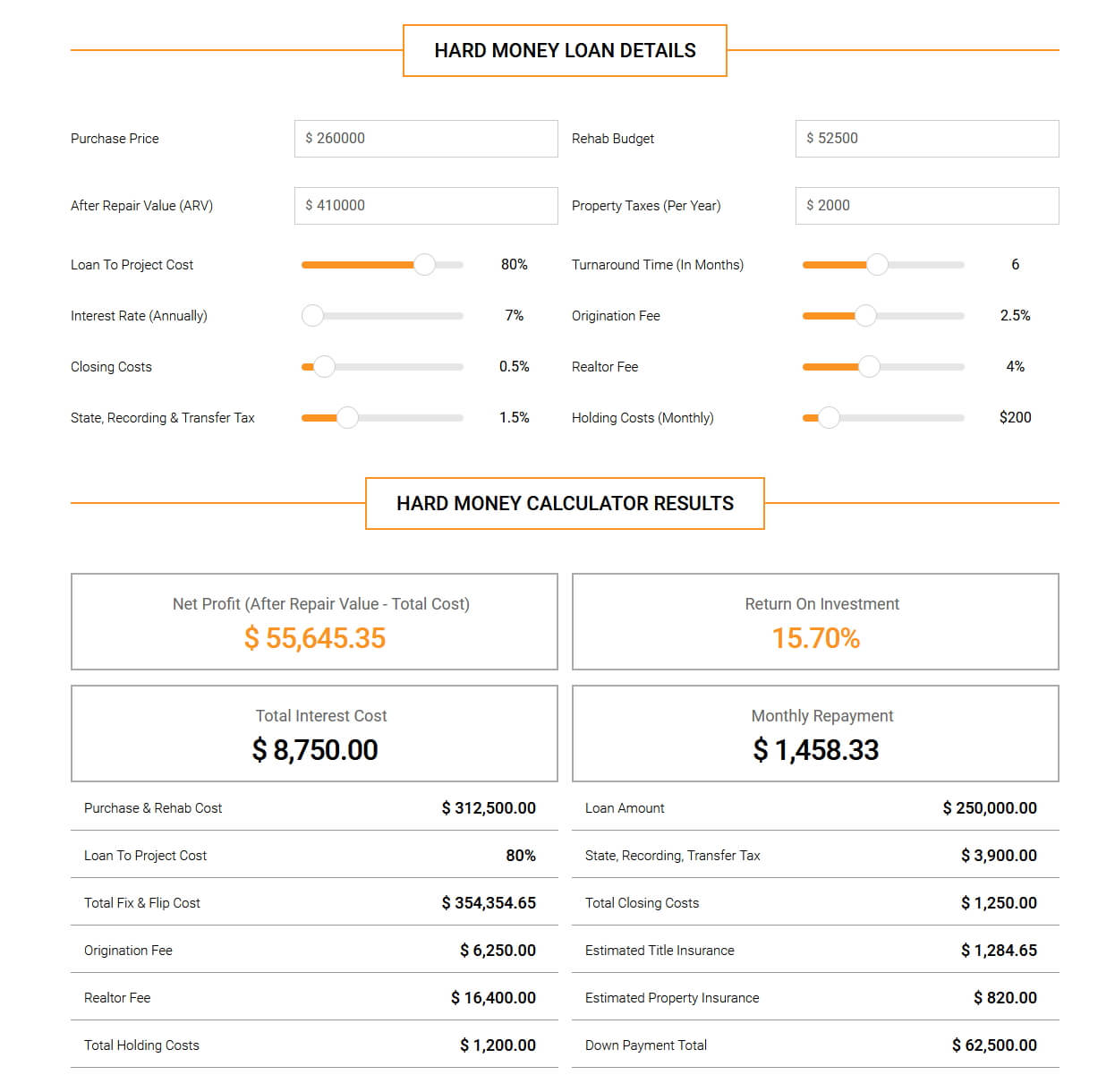

You can tackle tasks incrementally with these tactical lendings that enable you to rehab with just 10 - 30% down (depending upon the lending institution). Difficult cash financings are generally temporary financings utilized by real estate investors to fund solution as well as flip residential properties or other property financial investment offers. The property itself is used as security for the financing, and the top quality of the actual estate deal is, consequently, more vital than the consumer's creditworthiness when qualifying for the funding.Nevertheless, this likewise implies that the threat is greater on these car loans, so the rate of interest rates are generally greater as well. Fix as well as you can look here turn capitalists pick hard money since the marketplace doesn't wait. When the possibility offers itself, and also you're prepared to get your task into the rehabilitation phase, a tough money car loan obtains you the money straightaway, pending a reasonable evaluation of the business bargain.

However inevitably, your terms will rely on the hard cash lender you select to deal with as well as your distinct circumstances. Below's a listing of normal requirements or certifications. Geographical place. The majority of hard money lending institutions operate locally or just in particular Extra resources regions. Numerous run across the country, Kiavi currently provides in 32 states + DC (and also counting!).

Getting My Hard Money Atlanta To Work

Intent and residential property paperwork includes your in-depth range of work (SOW) and insurance policy (hard money atlanta). To assess the residential or commercial property, your lender will consider the worth of similar buildings in the area and their estimates for development. Adhering to a quote of the residential property's ARV, they will money an agreed-upon portion of that value.This is where your Extent of Job (SOW) comes right into play. Your SOW is a paper that details the job you intend to execute at the blog building as well as is generally required by many tough money lenders. It consists of renovation prices, responsibilities of the events involved, as well as, frequently, a timeline of the deliverables.

For instance, let's think that your home does not have an ended up basement, yet you are preparing to complete it per your scope of job. Your ARV will certainly be based on the offered costs of comparable homes with completed cellars. Those prices are likely to be greater than those of homes without finished cellars, hence boosting your ARV as well as possibly certifying you for a higher funding quantity. hard money atlanta.

Report this wiki page